All Categories

Featured

Table of Contents

Picking to spend in the property market, stocks, or other typical kinds of assets is sensible. When making a decision whether you should spend in accredited capitalist opportunities, you ought to stabilize the trade-off you make between higher-reward prospective with the lack of coverage needs or regulatory transparency. It should be said that personal positionings require greater degrees of threat and can on a regular basis stand for illiquid investments.

Particularly, nothing here ought to be analyzed to state or suggest that past outcomes are an indication of future performance neither need to it be interpreted that FINRA, the SEC or any type of various other safeties regulatory authority accepts of any one of these safeties. Additionally, when evaluating private positionings from sponsors or firms using them to accredited investors, they can provide no warranties expressed or suggested as to accuracy, efficiency, or results obtained from any details provided in their discussions or discussions.

The business should provide details to you through a file called the Exclusive Placement Memorandum (PPM) that supplies a much more detailed explanation of costs and risks connected with joining the investment. Interests in these bargains are only provided to individuals who certify as Accredited Investors under the Stocks Act, and a as specified in Section 2(a)( 51 )(A) under the Business Act or an eligible worker of the management company.

There will not be any public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were known for their market-beating performances. Some have actually underperformed, particularly throughout the financial dilemma of 2007-2008. This different investing technique has a special means of operating. Generally, the supervisor of a mutual fund will establish apart a portion of their available assets for a hedged wager.

Why should I consider investing in Accredited Investor Rental Property Investments?

For instance, a fund manager for a cyclical field may devote a section of the assets to supplies in a non-cyclical market to balance out the losses in instance the economic climate storage tanks. Some hedge fund supervisors make use of riskier techniques like using borrowed cash to purchase even more of an asset just to increase their potential returns.

Comparable to common funds, hedge funds are properly handled by occupation capitalists. Unlike shared funds, hedge funds are not as purely regulated by the SEC. This is why they undergo much less analysis. Hedge funds can apply to various financial investments like shorts, options, and by-products. They can likewise make alternative investments.

Who offers the best Accredited Investor Real Estate Syndication opportunities?

You may choose one whose investment ideology straightens with yours. Do bear in mind that these hedge fund cash supervisors do not come cheap. Hedge funds normally charge a cost of 1% to 2% of the properties, along with 20% of the revenues which functions as a "efficiency cost".

High-yield financial investments attract many financiers for their cash circulation. You can buy a property and obtain awarded for keeping it. Approved capitalists have a lot more possibilities than retail financiers with high-yield financial investments and past. A greater range offers recognized capitalists the opportunity to get higher returns than retail investors. Approved capitalists are not your ordinary investors.

Who has the best support for High-yield Real Estate Investments For Accredited Investors investors?

You should fulfill a minimum of one of the complying with parameters to come to be an accredited capitalist: You need to have over $1 million total assets, excluding your main house. Service entities count as recognized capitalists if they have over $5 million in assets under management. You need to have an annual income that surpasses $200,000/ year ($300,000/ year for partners submitting together) You need to be a licensed investment consultant or broker.

As a result, accredited investors have much more experience and cash to spread out throughout assets. Approved investors can go after a broader series of properties, but extra choices do not ensure higher returns. Many financiers underperform the marketplace, including certified capitalists. Regardless of the higher standing, accredited capitalists can make substantial blunders and do not have accessibility to insider details.

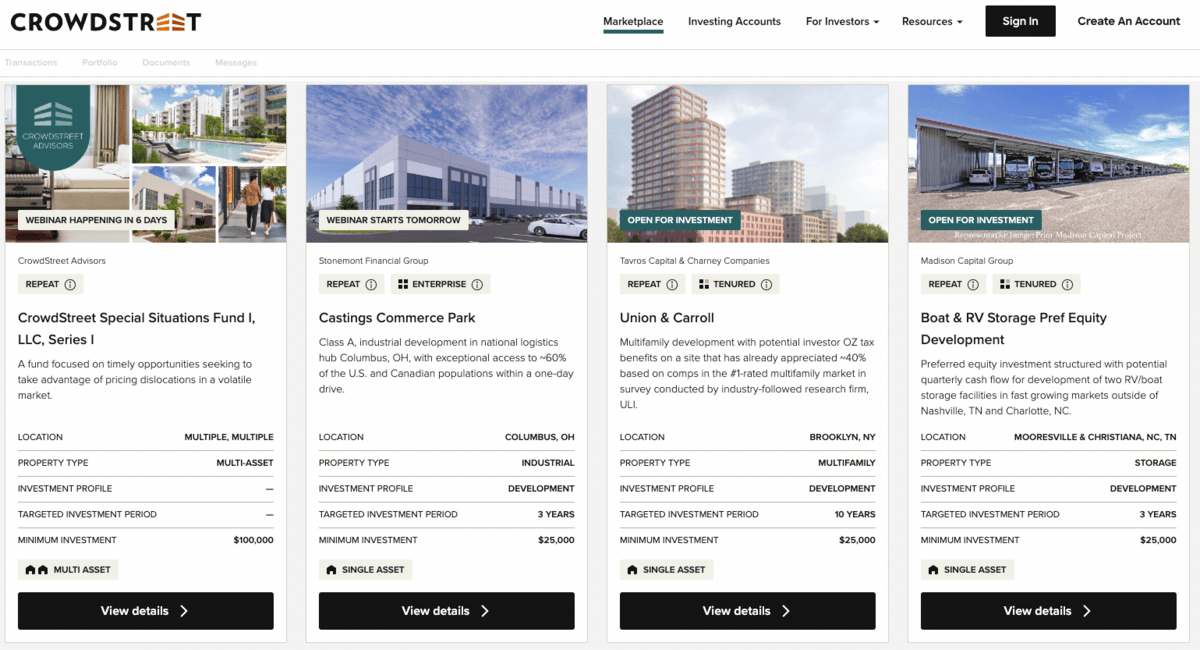

Crowdfunding offers recognized financiers a passive function. Actual estate investing can aid change your revenue or bring about a quicker retirement. In enhancement, investors can develop equity through positive money circulation and residential property admiration. Actual estate residential or commercial properties require significant upkeep, and a lot can go incorrect if you do not have the right team.

Who offers flexible Accredited Investor Real Estate Platforms options?

Genuine estate distributes merge money from accredited investors to buy buildings lined up with well established objectives. Certified financiers merge their money together to finance acquisitions and building growth.

Genuine estate financial investment trust funds have to disperse 90% of their taxed earnings to shareholders as rewards. REITs allow financiers to diversify rapidly across several home classes with really little resources.

What happens if I don’t invest in Commercial Property Investments For Accredited Investors?

The owner can make a decision to implement the exchangeable choice or to offer before the conversion occurs. Convertible bonds enable financiers to acquire bonds that can become supplies in the future. Capitalists will benefit if the supply cost rises since convertible financial investments provide much more eye-catching access factors. If the supply tumbles, capitalists can decide against the conversion and shield their financial resources.

Table of Contents

Latest Posts

Back Taxes Foreclosure Homes

Land For Sale Taxes Owed

Buying Delinquent Tax Bills

More

Latest Posts

Back Taxes Foreclosure Homes

Land For Sale Taxes Owed

Buying Delinquent Tax Bills